Tapping into different audience demographics with addressable TV

TV is an incredibly strong advertising medium. And ongoing development of the technology powering addressable TV advertising is allowing advertisers to reach more targeted audiences across a range of attributes than ever before. It should, therefore, represent an increasingly important component of the media mix for existing broadcast TV advertisers, as well as those brands who are newer to TV advertising.

Linear broadcast TV channels carrying advertising are watched by roughly three-quarters of consumers in developed markets on a weekly basis. But this still leaves roughly a quarter of individuals unreached. And as linear broadcast TV viewing continues to decline, driven by consumers switching to streaming services, this ‘unreached' audience grows larger every year.

Addressable TV services play an important role in ensuring that marketers can extend the visibility of their products and services to this audience unreached by linear tv, and ensure that the context of advertising consumption is comparable to broadcast TV – i.e. high-quality video advertising is paired with high-quality TV, film and sport content.

On a weekly basis, 19% of internet users in the UK, USA, Australia and Germany report watching ad-supported video services (from a broadcaster, long-form AVoD (advertising video on demand) platform, or YouTube) but not watching TV via any commercial broadcast channels. The result of this is that combining broadcast TV advertising with advertising on addressable TV-capable streaming platforms delivers a significantly greater breadth of audience than using either one in isolation.

Addressable for all age groups

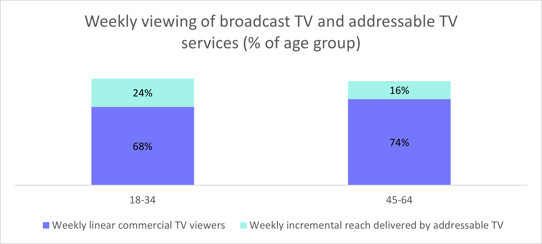

Many advertisers rely on addressable TV platforms to engage younger audiences, who have been the most active in switching their viewing away from broadcast TV. By contrast, older audiences can typically be reached easily through linear TV channels, and for many advertisers, spend on broadcast TV advertising reflects this. However, older consumers now represent the fastest-growing segment of streaming video viewers, which means that advertisers who want to target older consumer groups should seriously consider addressable TV options for their media mix.

In developed markets, 16% of 45- to 64-year-olds now report watching an ad-supported video-on-demand platform in any given week, but no commercial broadcast TV. YouTube has the largest weekly audience reach for this age group, but broadcaster-led video-on-demand (BVoD) services like the UK’s ITVX or Australia’s 9Now are also popular in their respective markets, with BVoD products reaching more than 40% of 45 to 64s in the UK and Australia on a weekly basis. Reach is lower in Germany at 17%, but broadcaster-led video-on-demand services nonetheless remain the most popular category of ad-supported streaming products after YouTube. In the US, AVoD services like Pluto, Tubi and Roku reach 39% of 45- to 64-year-olds.

Source: Consumer survey of 8,000 18- to 64-year-olds in US, UK, Germany, Australia

Source: Consumer survey of 8,000 18- to 64-year-olds in US, UK, Germany, Australia

Unsurprisingly, the incremental reach provided by streaming video services is even more pronounced among younger consumers, with streaming addressable TV reaching a further 24% of 18- to 34-year-olds over and above linear TV on a weekly basis. Advertisers targeting younger groups should alter their media mix to further weight towards addressable TV platforms as a result. It is worth noting that while this demographic pattern is a universal trend, global advertisers should consider that the exact platforms via which consumers can be reached will vary by market. European and Australian 18-34-year-olds are regular users of BVoD services. However, in the US, hybrid SVoD (subscription video on demand) services provide a key opportunity to reach these younger audiences. Almost half of 18 to 34-year-olds in the US engage with an ad-supported tier of a subscription streaming product every week, with Peacock and Hulu being the most popular among the group.

Young consumers are also generally receptive to addressable TV advertising. More than three-quarters of 18- to 34-year-olds are interested in seeing addressable TV ads relevant to their location, while more than two-thirds are interested in seeing advertising aimed specifically at their demographic group.

Relevance always matters

Relevant advertising messaging is important to all age groups. Research on creative messaging optimization revealed that the right creative elicits positive emotion, which ultimately influences short-term sales and long-term brand growth.

While older consumers are generally more wary of targeted advertising than younger groups, two-thirds of older consumers are still interested in seeing advertising relevant to their location and just over half are interested in seeing adverts for products relevant to their demographics.

There are further advantages for brands; finding the right target audience for their product and tailoring the message accordingly ensures a much higher hit rate than untargeted campaigns. An interview with an education brand in APAC targeting prospective students indicated that addressable TV advertising helps them spend efficiently and avoids alienating future prospects. In relation to advertising to consumers outside their target audience, the view was clear: “[It] wastes your money, but it annoys [consumers] to the point where if they ever are prospects in the future [they will be] sick of seeing something that was never relevant to them”.

Overall, there is a strong argument for brands to ensure that their approach is diversified. Linear TV alone reaches large audiences, but it is no longer capable of delivering exhaustive campaign reach, even among older consumer groups. Adding addressable TV to the mix immediately enhances reach and opens up targeting capabilities to deliver the advertising messages that consumers want.

Download Unlocking the Potential of Addressable TV